Disclaimer: I am merely an amateur enthusiast, and not an economist nor a financial advisor. Your millage may vary.

Preamble

As a result of the Global Financial Crisis in 2007, I took a much more rigorous look into investing, (hence this blog/presentation), which naturally led to the topics of inflation vs deflation, and the nature of money. Many questions bugged me, such as: "Why to the RBA target 2-3 percent CPI, and why is that the sweet spot?", and "What does an economy 'running too hot' actually mean?". I now think that I have a solid enough understanding to be able to answer most of these types of questions. In this article, I hope to give you some of that understanding, although I don't intend to directly answer those questions!

What is money?

Let's start with a definition of money. The best definition that I have heard for money is formalized obligation. Obligations are simply IOUs.

So, where did money come from? Despite the popular belief that money arose out of the barter system to solve the double coincidence of wants, money, as formalized obligation, simply evolved from less formal obligation, ie, informal obligation.

Informal obligation is the sense in your mind that either you owe somebody something, or they owe you something, as in "Thanks mate - I owe you one". The formalization increases - but not quite to the point of money yet - once these obligations begin to be tracked over time, as in Brownie Points!

Let's consider brownie points between you and your significant other. You buy you SO a great birthday present - you gain some brownie points. You miss the mark with the birthday present and it isn't well received - you lose some brownie points. Neither you or you SO actually keep track of the points formally, but both of you keep a rough ledger of who owes whom.

In the receiver's head, an IOU pops into existence - eg, "Wow, I had better get her a birthday present just a good as this one", and simultaneously, in the giver's head, a UOI, for want of a better term, pops into existence - eg, "I'm gonna get some tonight". With some luck, later that night, the IOU/UOI pair might vanish from existence, as the debt is repaid.

Obviously, the lack of formalization can lead to disputes about exactly how much one person owes another. One form of this is commonly known as not pulling your weight. When a group decides that someone isn't pulling their weight they can raise this issue, however when the response is "Yes I am", the only way the issue can be resolved is to formalize the tracking of contributions and therefore obligations.

Another issue that can arise from the lack of formalisation of the IOU is the exact terms of the IOU. Is there an expiry date? Does the IOU bear interest? Is the IOU transferable?

Have you ever been in the situation involving three people, where somebody both owed, and was owed, the same amount of money, and that person tried to remove themselves from any further obligations by linking the other two - "Hey, if Adam owes me $20, and I owe Zac $20, can we all just agree that Adam owes Zac $20?", and in the nod of heads, a primitive payment was made.

So, payments, in there simplest form, are simply a mechanism to adjust two obligation ledgers - to extinguish the IOU and the UOI, which are simply the two sides of the same obligation between the giver/receiver, lender/borrower or creditor/debtor.

The process of obligation formalization can be contractualization, tokenization, digitization, or serialization of this mental construct - the IOU/UOI pair. The formalization into a contract can take various forms, from a Note, Bond, Cash Note or Coin, Casino Chip, or a digital record in database. Once the obligation is formalized, we have money!

It is often said that money must be a) a unit of account, b) a medium of exchange, c) a store of value, however while this is true for a monetary system, it does not need to be true for a particular form of money. That is, there is no need that the medium of exchange also be the medium to store value. In fact, the monetary system will be more stable if these roles are kept separate.

Here are some examples of ye olde money:

|

|

|

|

Note the text: "We promise to pay the Bearer the Sum of One Pound Sterling" - unquestionably formalized obligation.

In Australia, before 1911 when the Bank Note Act was introduced, it was the private bank notes that circulated as currency. After the Act was introduced, it was the national currency that circulated. Importantly, the concept of bank IOUs as distinguished from government IOUs still exists in the world today, but as digital credits, it is much harder to distinguish between them. Indeed, you probably don't even know that you exchange bank credit for government credit every time you withdrawal cash from the ATM.

The above bank notes are also the simplest form of a derivative. None of these notes are a One Pound Stirling note. They are Australian Pty Ltd bank IOUs for British Government IOUs. Being derivatives, there are inherent risks involved. Will the bank stay in business? Will it honor it's promise to pay the bearer? If the bank does honor it's promise, will the British government honor it's promise to pay "One Pound Stirling"? One Pound Stirling of what? That promise was long defaulted on!

Another risk within these bank note derivatives was whether on not the note would be accepted at face value by the market. Given that the Bank of Paramatta only existed for FOUR years, would you hand over your goods for the face value of these notes?

The Monetary Plane

Here we draw a distinction between the physical plane, consisting of real tangible goods, and the monetary plane, consisting of financial products, including cash.

Using our original definition of money, we can see that everything in the monetary plane is an IOU, or debt based, whereas the physical plane consists of real assets. We also see that only way we know the worth of things in the monetary plane is by the magnitude of the number associated with it, whereas the items in the physical plane have a real value to the holder of the item.

As stated above, IOUs are, by definition, supposed to be repaid. Once they are repaid, they disappear. In this regard, they are very much temporary in nature. Imagine finding a 500 year old treasure chest, only to open it and find IOUs inside. In a similar vein, the IOU is going to be paid back in the future, whereas physical item exist in the here and now, and can be enjoyed in the here and now.

Do you have any family heirlooms? If you do, I bet they are physical items and not monetary items. Because of the temporary nature of the monetary plane items, they simply cannot survive through the generations like physical items can. Thus, those planning to leave wealth to their heirs (and their heirs) would only consider physical items, and not monetary items.

A final point to make on the monetary plane is that we once again see chains of derivatives - IOUs for IOUs. All financial products are ultimately derivatives of cash, and so if cash is ever questioned, the derivatives chain (ie the entire monetary plane) can collapse.

Inflation

The original definition of inflation was an increase in the volume or amount of money, whereas the modern definition of inflation is an increase in the price of consumer goods. Nowadays, I only use the terms monetary inflation and price inflation, but never the generic and ambiguous term inflation, so as to avoid confusion.

Monetary inflation causes price inflation. Without the distinction in terminology, we are left with the phrase "inflation causes inflation", which can easily be misread as a truism, or that inflation "just is". No. Monetary inflation causes price inflation.

Monetary inflation has other names, such as "expansionary policy", "monetisation", "quantitative easing", etc. By and large, this is because "money printing" would be too obvious, and the currency issuer does not want the currency user to be aware of the dilution of the currency being held.

Fractional reserve banking leads to monetary inflation, because as the deposits in the bank grow, the amount of bank credit grows by a multiple.

Central banks control price inflation primarily by controlling lending, by setting wholesale lending interest rates.

Drawing a distinction between (generically) inflation and hyperinflation, I see inflation as a supply side issue, and hyperinflation as a demand side issue. When the supply of dollars increases, prices will rise. These prices rises tends to be exponential, as they rise by a fixed percentage each period. This however, is not a big issue (except for the savers of those dollars), as exponential functions can continue indefinitely. However, when trust in dollars is questioned, the function becomes hyperbolic, and prices can go to infinity in a finite amount of time. This is hyperinflation.

Monetary System Problems

It is very true that the gold standard is a barbarous relic. Using physical gold, gold receipts, or arbitrary tokens linked to gold at a fixed exchange rate is destined to fail. At the broadest level, the biggest problem is that the system runs out of tokens because the long term net producer end up with all the tokens. Also, given that the nature of money is simply an IOU, a system that has a fixed number of tokens with an arbitrary set of IOUs is going to be often strained. Finally, all gold standard systems eventually become fractionally reserved, leading to under-priced physical gold and overpriced IOU-for-physical-gold, leading to a run on physical gold and the collapse of the system as it is known and used.

As shown above, the problem with the Gold standard is that it tried to move gold from the physical plane into the monetary plane. The problem with the current USD standard (Bretton Woods II), is that is tries to to move USD (and derivatives including TBonds, etc) into the physical plane, as "savings" "assets". This encourages savers to save in IOUs, which are temporary, decaying value, debt.

Debt must be temporary. The moment that a debt become permanent, as in - "This debt will never be repaid", it may as well not exist, and so it gets written off, and disappears - both from the debtor's ledger - "I'm never paying that back", and from the creditor's ledger - "I'm never seeing that again".

This system will collapse when savers realize the folly in saving their surplus production in debt, which will become obvious when the USD hyperinflates.

The Euro

The history of the Euro is one of the most important developments in the history of money, and it is also one of the most misunderstood. It was devised in the 60’s once the inevitable failure of USD system was realised. It was launched several decades later circa 2000.

Think about what forces would need to be at play for a nation to give up currency issuance. It was not done on a whim.

Before the introduction of the Euro, if the US dollar had collapsed, world trade would have stopped. So, using an IT analogy, I see the Euro as the the world’s DR (Disaster Recovery / Backup) trade currency. Since it's launch, it has been running running in Active / Active mode. That is, both the current system and the backup system are both currently actively running. Having the Euro up and running whilst the US dollar system is still running allows all the teething issues with the Euro management to be resolved (in a non fatal way). In this regard, the 2008 Crises was DR performance test, and although the Euro passed the test, some issues where identified, and the EU Banking regulation is being tweaked as a result. So, the Euro is now in great shape for the next crises, during which time the "backup" world trade currency may displace the "current" world trade currency.

One of the advantages that the Euro has is the single mandate: 2% inflation. There is no mandate to "create jobs" (whatever that means for a currency issuer). So, beware of currency issuers with multiple mandates, as that only indicates that they either have no mandate, or at least a non-public mandate.

Another advantage that the Euro has is that it is not politically linked to any government. That is, it never needs to fund government deficits, and can make "bailout" decisions based on its single mandate - 2% inflation.

Importantly, the Euro is designed to strengthen as other currencies weaken, as it "marks to market" its gold on its balance sheet, and so the Euro strengthens on a rising gold price, whereas the USD weakens.

Gold was the enemy of the USD, but is a friend of the Euro.

Currency wars

The war is not between the currencies of the individual countries. Instead the war is between two ideals - the USD group vs the Gold group. China, Europe (17+), Brazil, Russia, India, South Korea et al versus the United States, Japan, United Kingdom et al.

The game is how to transition from the USD trade currency system to a Gold trade currency system without war.

The way that I visualize the situation is to envisage two poker tables - the current green table one and the next future yellow table. Everyone is currently playing on the green table, where green chips are valuable, but most big players have also realized that everyone will soon be playing on the yellow table, where yellow chips will be important. So, what do you do? Well, you don't want to be blamed for causing the green table game to end, so no one can directly sell their green chips for yellow chips, but the subtle accumulation of yellow chips is the name of the game.

The world simply wants to move away from a system that allows the US to import free stuff, which requires that other parts of the world export real stuff for free.

Government deficits are funded with currency issuance in the form of Treasury Bonds. Some of these bonds end up overseas (equal to the trade deficit) and the rest must be bought up from within the US.

The US government deficit is currently twice the size of the US trade deficit, so there are many bonds needing a home within the US. In order to keep interest rates fixed low, the US Fed must buy some of the bonds. Currently, the US Fed buys nearly 70% of the issued bonds.

A valid question on the imminent collapse of the US dollar is "Why hasn't it happened yet?" The answer is that over the last 30 years the US dollar has received structural support from those that need time to prepare themselves. In the 1980s and 1990s, it was the Europeans that "saved" the flow of US bonds - building ever growing piles of USD, to hide the problem, and prevent the currency from collapsing. Then, when the Euro was launched, this support was withdrawn.

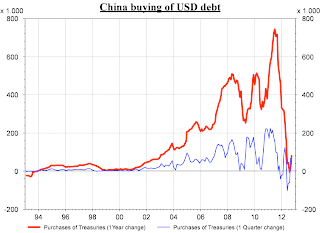

The Chinese then realized that they were ill prepared for the transition from the USD system to the Gold system (ie, they didn't have enough gold), and so the Chinese supported the USD system by saving piles of USD until they were ready.

Now that this support has been removed, it appears that very little external support exists for the dollar, and that most of the big players have enough Gold chips to ensure a reasonably equitable start to the next system.

The Future

Let me summarize my predictions for the future.

- The Euro will win the currency war.

- The JPY, GBP and USD are all toast, and probably in that order.

- The hyperinflation of those currencies will be a humanitarian disaster.

- Timeframes are hard to predict, but as Trustee for a number of Investment Trusts, it will happen on my watch.

- Countries will continue to join the Euro, including Latvia, Romania, and perhaps a little cheekily, I'll include Scotland, United Kingdom and Panama.

- Trade imbalances will not be "settled" in (IOUs!) USD, they will be settled in Gold. Quid pro quo. Stuff for stuff.

- The FIRE industries are in danger of a major downturn.

- The future of the AUD, CAD is hard to determine, as their future is in political hands. Will the Australian Government & RBA go down the the USD ship (ie, Will they protect the AUD/USD exchange rate), or will they protect their inflation target?

- Digital currencies will crash.

A final chart on timing. The following chart shows how much stuff (commodities baskets) you can buy with the interest from lending the (presumably US) government $1,000.

When you can by nothing with the interest from lending the government money, the money has essentially become worthless, and its collapse is truly imminent. As you can see, the line hits zero around 2013 - 2015, so now is the time to be paying attention.

Cheers,

No comments:

Post a Comment